Part 5:

What do Zillennials plan to invest in?

The Zillennial Investing Report

NFTs ETFs IRAs etc...

All the investing acronyms your peers throw around – but who is investing in them, and which are the most popular?

In the latest edition of the "ya, but who cares?" Zillennial Investing Report, we asked our survey respondents how they allocated their money between different investment types and asset classes. An asset class is a group of securities ("investments"), which may behave similarly in the market. Here were the options:

SINGLE STOCKS & BONDS

INDEX FUNDS

ETFS

CRYPTOCURRENCY

PHYSICAL ART

REAL ESTATE

NFTS

NONEWe then asked respondents to list any asset types not included above. Their answers made up less than 1% of total responses:

OPTIONS

COLLECTIBLE FURNITUREPRIVATE COMPANIES (ANGEL, PRIVATE EQUITY, AND VENTURE CAPITAL)InsightReal estate was the most popular future investment, with 47% of Zillennials saying they plan to invest in this asset class

What do Zillennials plan to invest in?

Buying a home is a part of the American Dream and has long been considered one of the most worthwhile and enduring investments. Our respondents expressed the most interest in real estate as a future investment vehicle. Congrats! This suggests that Zillennials appreciate the value of long-term financial security through more stable investments.

InsightAsian people were most likely to plan to invest in less volatile assets classes like Index Funds, ETFs

What do Zillennials plan to invest in?

While some level of risk is unavoidable when investing, there are many ways to minimize risks. Our study revealed that Asian respondents were most likely to take the former route and invest in less volatile asset classes.

Index funds and ETFs tend to be safer than other equity-based asset classes like single stocks because they track the movement of a group of stocks rather than following the performance of an individual company, thus shielding you from a phenomenon called unsystematic risk (according to finance bros). This term refers to risks inherent to a specific company, such as having Adam Neumann as your CEO. However, index funds and ETFs cannot protect you from broader market trends such as inflation or a pandemic. There is also significant variability in the stocks or bonds included in a single index fund or ETF, meaning that some are riskier than others.

InsightBlack people were most likely to plan to invest in crypto and NFTs

Interest in the crypto space was stronger among the Black population than in any other racial or ethnic group in our sample. 52% of the Black participants in our survey said they plan to invest in crypto, while 35% plan to invest in NFTs. By comparison, 41% of white individuals said they intend to invest in crypto in the future, while 21% plan to get into the NFT game.

The Black community’s embrace of crypto is a broader trend. Research conducted by Ariel Investments and Charles Schwab Corp in January of this year discovered a nearly identical gap. Their survey shows roughly 38% of Black Zillennials (ages 18-40) owned digital tokens, compared with 29% of their white counterparts.

The crypto space is advertised as an alternative to the traditional banking system that eliminates intermediaries. This messaging is desirable to minority communities who have been historically excluded from the economy in innumerable ways and have lacked opportunities to generate wealth.

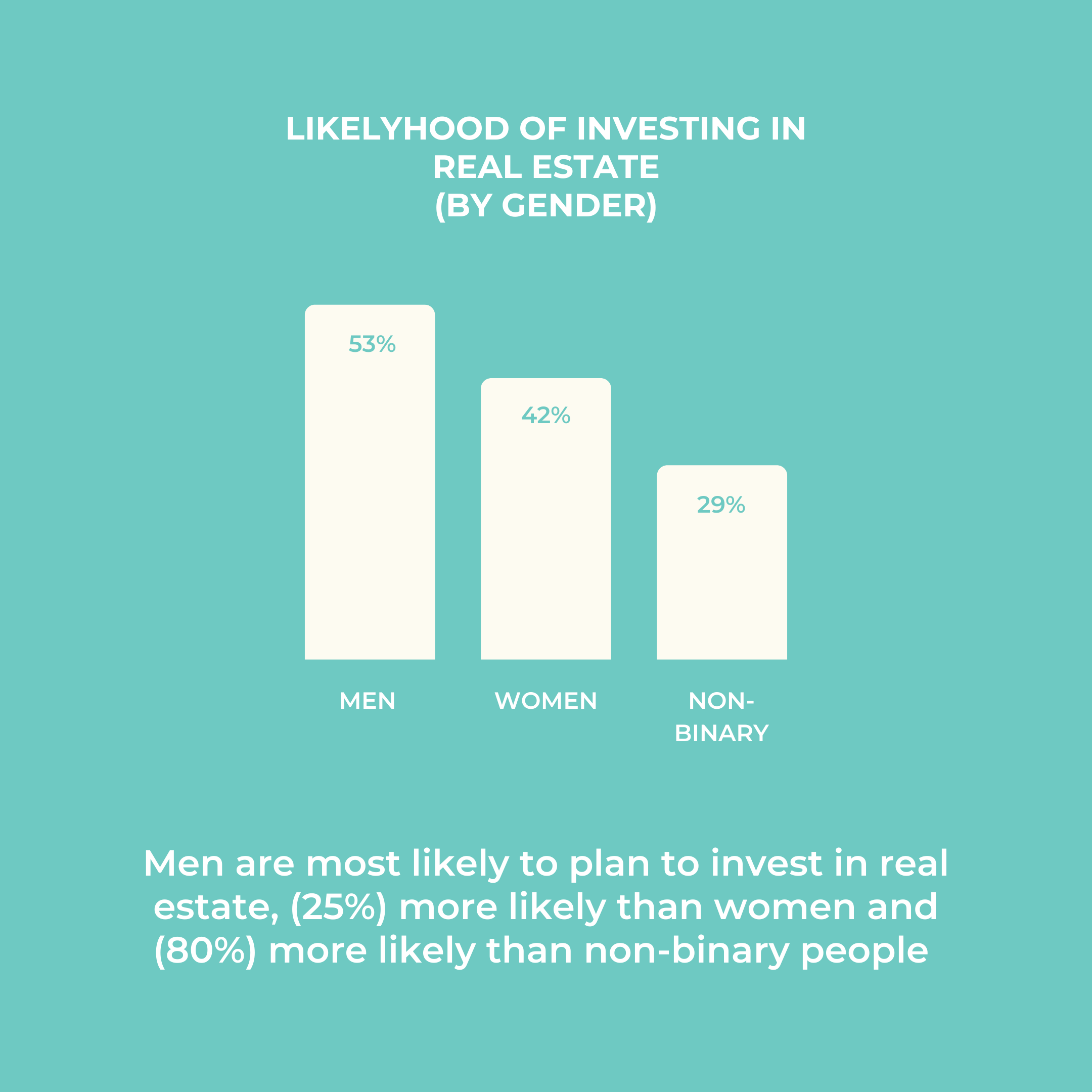

InsightMen are 25% more likely to plan to invest in real estate than women

To examine this insight, let's travel back in time a bit. It's important to remember that many of the rights women enjoy today in the United States are less than a century old. Women began fighting for property rights in the 1700s and were legally granted that right in the early 20th century.

Despite the gender disparity suggested by this insight, more and more women are becoming homeowners. According to the Urban Institute, "the homeownership rate among women increased from 50.9 percent to 61.2 percent between 1990 and 2019, while the homeownership rate among men dropped from 70.6 percent to 67.1 percent."

While more women are becoming homeowners overall, there are still many challenges they face compared to their male counterparts, including the persistent gender wage gap, which affects their financial ability to buy a home.

InsightMen were most likely to plan to invest in crypto almost 1.5 times more likely than women, 4 times more likely than non-binary

Cryptocurrency is an asset intended to democratize the investing space, but the current reality isn't shaking out that way for women, according to our survey. Male Zillennials were almost 1.5x more likely than women to say they plan to invest in the space. Other studies on this topic have come to similar conclusions, such as a recent survey from Pew Research that found twice as many men ages 18 to 29 say they have invested in, traded, or used a cryptocurrency compared to women of the same age group.

Women's reluctance to invest in crypto may not be due to a lack of knowledge but rather an aversion to volatility and weak regulation. A study by GoBanking Rates found that 25% of women don't trust the security of cryptocurrency, compared to 30% of men. And who's to blame them! Taking a cautious approach to crypto may prove to be a win for women.

InsightThe most popular assets women plan to invest in are Single Stocks (46%), Real Estate (42%), and Index Funds (40%).

For Zillennial women, the preferred portfolio appears to contain a mixture of single stocks, real estate investments, and index funds. By focusing on more stable investments, women can cultivate an ability to 'ride out' market lows. According to a Fidelity study analyzing the performance of customer accounts over 9 years, women's investment returns are typically about .4% higher than men's. Rather than putting their money into risky assets that are 'hot and new' (i.e. crypto), Zillennial women seem to prefer taking appropriate, calculated risks.